Employers have a responsibility to protect their employees from scams and frauds. In recent years, impersonation and pension scams have become increasingly prevalent, posing a significant threat to the financial wellbeing of individuals and businesses alike. As such, it is crucial for employers to take proactive measures to safeguard their employees against these types of scams.

Impersonation scams involve criminals posing as legitimate individuals or organizations, such as banks or government agencies, to trick victims into providing personal or financial information. Pension scams, on the other hand, typically involve fraudsters convincing individuals to transfer their pension savings into fraudulent schemes. Both types of scams can have devastating consequences for victims, including financial loss, identity theft, and emotional distress. By educating their employees on how to recognize and avoid these scams, employers can play a vital role in protecting their staff from harm.

- Preventing Impersonation Scams

- Preventing Pension Scams

- Reporting and Responding to Scams

Preventing Impersonation Scams

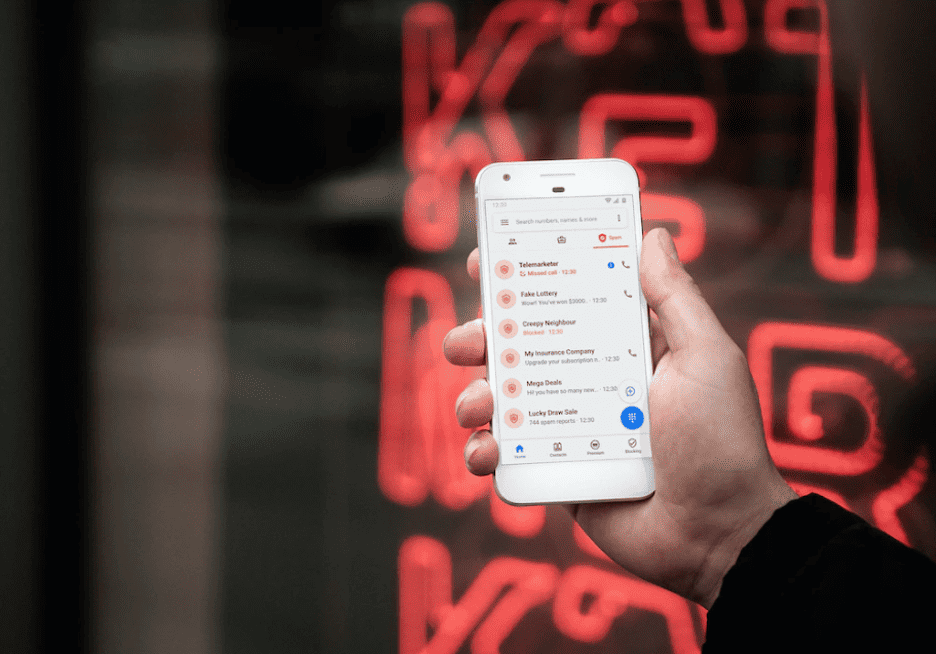

Impersonation scams are a common tactic used by fraudsters to trick employees into revealing confidential information or transferring funds to fraudulent accounts. These scams can be costly and damaging to both the employee and the company. Therefore, it is essential to take measures to prevent such scams from occurring.

One of the most effective ways to prevent impersonation scams is to educate employees about the risks and how to identify potential scams. This can be done through training sessions, workshops, and regular communication. Employees should be taught to verify the identity of the person they are communicating with, especially if they are requesting sensitive information or financial transactions.

Another important measure is to implement strict policies and procedures for verifying requests for sensitive information or financial transactions. These policies should include steps for verifying the identity of the requester, such as calling back on a known phone number or using a secure communication channel. Additionally, employees should be trained to recognize red flags, such as urgent requests, unusual payment methods, or changes in account information.

It is also recommended to implement technical controls, such as two-factor authentication, to prevent unauthorized access to sensitive information or financial systems. This can help to reduce the risk of impersonation scams and other types of cyber threats.

Overall, preventing impersonation scams requires a combination of education, policies, and technical controls. By taking these measures, companies can reduce the risk of fraud and protect their employees from financial losses and reputational damage.

Preventing Pension Scams

Pension scams can be devastating for both employees and employers. It is essential to take steps to protect your employees from becoming victims of pension scams. Here are some ways to prevent pension scams:

- Educate your employees: Educate your employees about the risks of pension scams and how to avoid them. Provide them with information about common scams and how to identify them. Encourage them to report any suspicious activity to the relevant authorities.

- Verify requests: Encourage your employees to verify any requests for personal or financial information before providing it. They should always double-check the identity of the person or organization making the request. If in doubt, they should contact the relevant authority or organization directly to verify the request.

- Use secure communication channels: Encourage your employees to use secure communication channels when discussing sensitive information. This includes using encrypted email, secure messaging apps, or secure file-sharing services.

- Regularly review pension accounts: Regularly review pension accounts to ensure that there are no unauthorized transactions or changes. If there are any suspicious activities, report them immediately to the relevant authorities.

By taking these steps, employers can help protect their employees from becoming victims of pension scams. It is essential to remain vigilant and proactive in preventing pension scams to ensure the safety and security of your employees’ retirement funds.

Reporting and Responding to Scams

In the unfortunate event that an employee falls victim to a scam, it is important to have a clear protocol for reporting and responding to the incident. By taking swift action, the employee’s losses can be minimized and the potential impact on the company can be mitigated.

Firstly, employees should be encouraged to report any suspicious activity or requests for personal information immediately to their supervisor or HR department. This includes unsolicited phone calls, emails, or texts from unknown sources requesting personal or financial information.

Once a scam has been reported, the company should take steps to investigate the incident and determine the extent of the damage. This may include reviewing security footage, conducting interviews with employees, or contacting law enforcement agencies.

If the scam involves the theft of sensitive information such as Social Security numbers or bank account details, the company should take steps to notify affected employees and provide them with resources for protecting their identity and finances.

In addition to responding to individual incidents, companies should also have a proactive approach to preventing scams from occurring in the first place. This may include providing regular training on how to identify and avoid common scams, implementing strong password policies, and monitoring employee activity for signs of suspicious behavior.

By having clear procedures for reporting and responding to scams, companies can help keep their employees safe and protect their business from potential financial losses.