As an employee, understanding your rights is paramount to ensuring fair treatment and compensation. The Fair Labor Standards Act (FLSA) establishes vital protections, including the right to fair compensation for time spent in training and meetings.

However, navigating the complexities of this law can be challenging. Why fair compensation is important to an employee cannot be overstated. It is not just about the financial aspect but also about feeling valued and recognized for one’s contributions.

This guide aims to provide you with the knowledge and strategies you need to assert your rights confidently. Get ready as we explore voluntary vs mandatory participation, job-related training and meetings, exceptions, and state regulations. Don’t let your hard work go uncompensated; equip yourself with the tools to navigate legal challenges and seek fair compensation.

Understanding Compensable Time

Understanding the concept of “compensable time” is crucial to asserting your rights effectively. The FLSA outlines specific criteria to determine when activities like training and meetings qualify for compensation. By grasping these criteria, you’ll be better equipped to identify instances where your time should be fairly remunerated. This knowledge empowers you to distinguish between voluntary and mandatory participation, recognize job-related activities, and navigate special situations and exceptions.

Job-Related Training and Meetings: When Are They Compensable?

One of the most common scenarios where compensation is required is when the training or meeting is directly related to your current job responsibilities. According to the FLSA, time spent in activities that enhance your job performance or skills is generally considered compensable. However, it’s important to distinguish between training that improves your current job performance and training that equips you with new skills for a different job.

In bustling metropolises such as Los Angeles, the line between enhancing existing skills and preparing for future opportunities can often blur, given the city’s diverse and rapidly changing employment industry. The latter may not be compensable under the FLSA, although there are exceptions to this general rule.

In such situations, consulting with wage and hour attorneys in Los Angeles can help make things clear. These experts understand the details of the FLSA and how it interacts with California’s labor laws, providing crucial advice to employees figuring out compensation for job-related training and meetings. Their knowledge is particularly valuable in a city famous for its entertainment, tech, and service sectors, where training needs and job functions often change.

Here are some examples of job-related training and meetings that are typically compensable:

- On-the-job training: Hands-on instruction or guidance provided by supervisors or experienced colleagues to improve your current job performance.

- Safety meetings: Meetings that discuss safety protocols, procedures, or hazards related to your current job.

- Product knowledge training: Training that enhances your understanding of products or services directly related to your job duties.

- Professional development: Workshops, seminars, or conferences that build upon your existing skills and knowledge in your current role.

In contrast, training programs that prepare you for a different job, career path, or profession may not be compensable, unless they are required by your employer and directly related to your current job duties.

Distinguishing Voluntary from Mandatory Participation

One of the most critical distinctions when it comes to compensation for training and meeting time is whether your attendance is truly voluntary or mandatory. Non-exempt employees (those covered by the FLSA’s overtime provisions) must be compensated for mandatory training or meetings, even if they occur outside of regular working hours.

However, voluntary attendance is generally not compensable. The key factor here is the consequences of non-participation. If you would face adverse consequences, such as termination or disciplinary action, for failing to attend, the activity is likely considered mandatory and therefore compensable.

Special Situations and Exceptions Under the FLSA

While the FLSA provides a general framework for determining compensable time, some specific situations and exceptions require careful consideration:

- Independent learning: If you are required to engage in independent study or self-directed learning activities that are directly related to your job, that time may be compensable, even if it occurs outside of regular working hours.

- Educational programs: Time spent attending vocational or university courses may not be compensable if the program meets certain criteria, such as being offered by a bona fide institution and not designed to meet specific needs.

- Travel time: In some cases, travel time to and from training or meetings may be compensable, depending on factors such as the location and duration of the travel.

- Meal and rest periods: Generally, bona fide meal and rest periods are not compensable, but if you are required to perform work duties during these times, compensation may be required.

It’s essential to consult with legal experts or employment law attorneys to fully understand how these exceptions and special situations may apply to your specific circumstances.

State-specific Regulations and Their Impact

While the FLSA sets federal standards for compensable time, many states have their laws and regulations that may offer additional protections or stipulations for employees. In some cases, state laws may be more favorable to employees than the FLSA, in which case the state law takes precedence. For example, some states have higher minimum wage rates than the federal standard of $7.25 per hour.

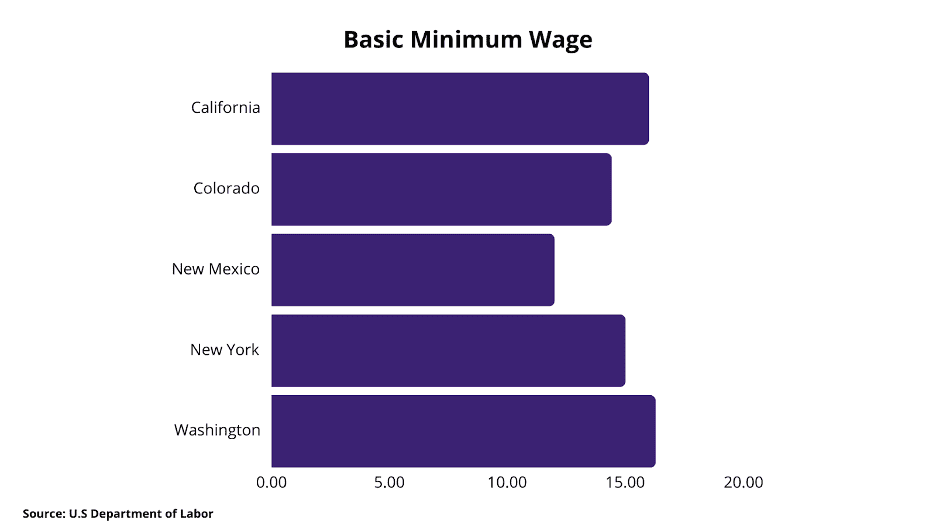

As of 2024, the state with the highest minimum wage is Washington, at $16.28 per hour. State-specific employment laws in places like California and New York have implemented more stringent requirements for compensating employees for training time. The chart given below lists the basic minimum wages of some states higher than the federal standard minimum wage.

To ensure you’re fully protected, it’s crucial to familiarize yourself with both federal and state-specific regulations regarding compensable time and employee rights.

Navigating Legal Challenges and Seeking Fair Compensation

Despite the legal protections in place, disputes over compensation for training and meeting time can still arise. If you believe you have not been fairly compensated, there are steps you can take to assert your rights:

Document everything: Maintain meticulous records of the training or meetings you attended, including dates, times, duration, and any evidence of mandatory attendance.

Communicate with your concerns: Schedule a meeting with your supervisor or HR representative to discuss your concerns and present your documentation. Many disputes can be resolved through open communication and a mutual understanding of the law.

Seek legal counsel: If your employer remains unresponsive or disputes your claims, consulting with an experienced wage and-hour law attorney may be necessary. They can evaluate your case, advise you on the best course of action, and represent you in legal proceedings if required.

It’s important to note that the FLSA includes provisions for recovering unpaid wages, liquidated damages, and attorney’s fees in successful legal actions. In 2020 alone, the U.S. Department of Labor recovered over $300 million in back wages for employees through enforcement of the FLSA.

Frequently Asked Questions

-

How do I determine if the training I am attending is considered “directly related to my job”?

The key factor is whether the training enhances your current job performance or skills. If the training is specific to your job duties, responsibilities, or tasks, it is likely considered directly related and therefore compensable.

-

Can I be required to attend training or meetings outside of my regular working hours without pay?

It depends on whether the attendance is truly voluntary or mandatory. If non-attendance would result in adverse consequences, such as termination or disciplinary action, the training or meeting is considered mandatory and must be compensated.

-

What steps can I take if I believe I have not been fairly compensated for mandatory training or meeting time?

First, document all relevant details of the training or meeting, including dates, times, and any evidence of mandatory attendance. Next, communicate your concerns and present your documentation. If your claims are disputed, consult with an experienced employment law attorney to explore your legal options.

Conclusion

Attaining fair compensation for training and meeting time requires knowledge and vigilance. By understanding the FLSA’s criteria, identifying job-related activities, and being aware of state regulations, you’ll be better positioned to confidently assert your rights. Remember, thorough documentation, open communication, and a willingness to seek legal counsel when necessary can increase your chances of receiving fair compensation.